Most people don’t realize this — but when a debt collector sends you a text message, it can break multiple laws.

They Texted You? That’s a Federal Violation.

If they:

Text you without your written consent 📵

Fail to identify themselves as a debt collector ⚠️

Send automated texts using robo or bulk systems 🤖

Don’t give you an opt-out option ❌

Or text you at night, at work, or multiple times 🚨

Even a single illegal text can:

Wipe a debt off your report

Stop all collector contact

Open the door for $500–$1,500 per message in compensation

If you’ve ever received a text from a collector — even once — you may qualify for a Rapid Removal.

How can a text message cause a deletion?

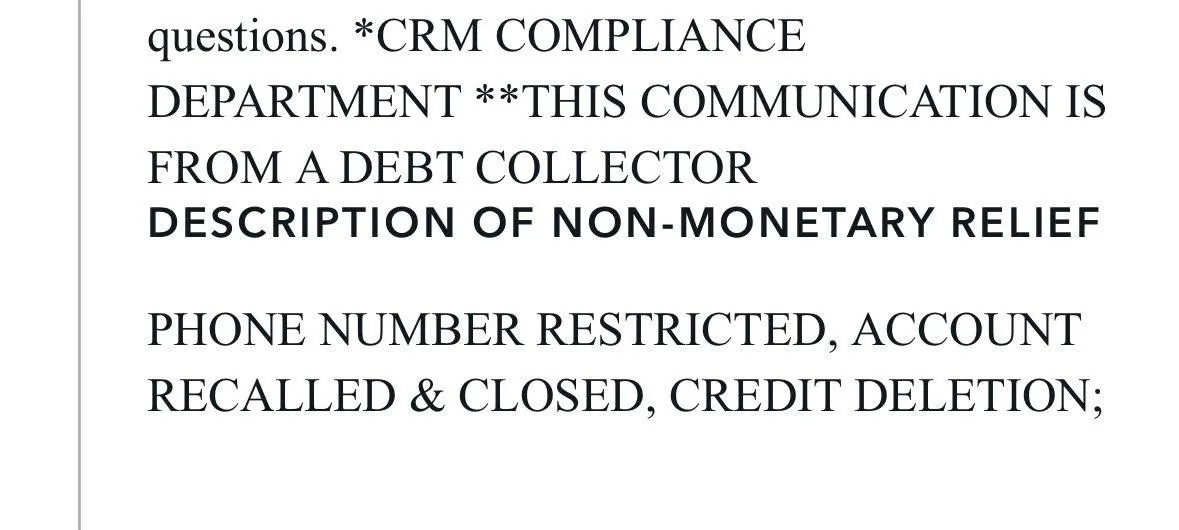

If a debt collector texts you without permission, fails to identify themselves properly, or uses automated messages, they’ve likely violated federal law.

We use those violations as leverage — demanding deletion of the account or pursuing penalties under the FDCPA, FCRA, or TCPA.

What happens after I sign up?

You’ll receive:

A secure client portal to upload your reports and communications.

A detailed FCRA/FDCPA/TCPA audit within 48–72 hours.

A custom removal plan designed to target your specific violations.

Then we go to work — sending your legal leverage letters and tracking the deletions step by step.

What laws protect me from illegal debt collection?

You’re protected by three main laws:

FDCPA (Fair Debt Collection Practices Act) – Regulates how collectors contact you

FCRA (Fair Credit Reporting Act) – Controls what can legally be reported

TCPA (Telephone Consumer Protection Act) – Protects you from unauthorized calls and texts

Our program uses these laws to remove, correct, or monetize violations on your behalf.

What results can I expect?

While every case is unique, many clients see:

⚡ Collections deleted within 7–21 days

📈 Credit score increases within 30–45 days

💰 Potential compensation for illegal contact

What if I never got a text — can I still qualify?

Yes!

Texts are just one of many ways collectors violate the law.

If you’ve received calls, letters, duplicate reporting, balance errors, or unverifiable data, you may still qualify for the program.

Do I need to prove the violation myself?

No — I handle that for you.

You’ll simply forward any texts, letters, or call logs, and we’ll conduct a forensic compliance audit to identify where your rights were violated.